Fintech Is Not Just Vibes — It’s the Future of Money

We throw “fintech” around like it’s just another tech buzzword, but this space is quietly (and loudly) changing everything. From how we save to how we invest, fintech is rewriting money rules in real time — and if you're not paying attention, you're playing catch-up.

But as usual my sugar babies, mama gat you!

Today we will be learning more about fintech but first of all introduction!

You know the vibe 😉

What is fintech?

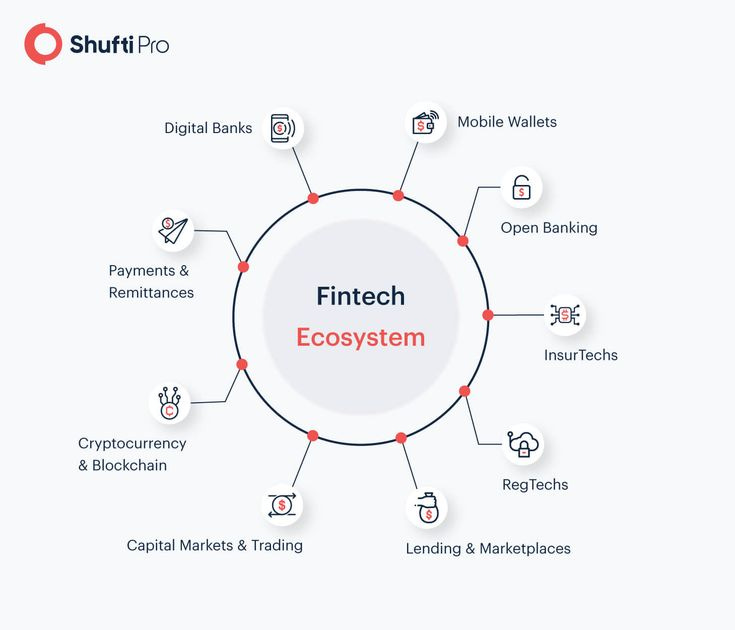

Fintech, short for financial technology, is a fusion of finance and technology. It's the innovation behind mobile banking, savings apps, crypto platforms, stock trading apps, and even loan apps and systems, you know.

Fintech exists to ensure that you can manage money easier. From my previous post about my first love, side chicks and entanglements, you will see that moving, managing and growing money is super easy because all I need is to have an internet connection, and boom, I can invest, save, make transfers, and even do it in foreign currencies.

So, yes, we are thinking of PiggyVest, Bamboo, Cowrywise, Binance, Luno, Chipper Cash, Rise Vest, Flutterwave, MonniePoint, and Paystack, and it has even integrated into conventional banks, where you have the bank apps for digital banking.

Why Fintech?

Fintech exists to move past traditional banking, as it is not for everyone and definitely not for the pace of the generation we are in. Imagine queuing to make transfers from your personal account when you have school or a 9-5; gosh, that seems unimaginable. Let’s not start the talk of the high fees, and the limited access to investment, credit, and basic services, Fintech came to flip the script.In our day, we young people want speed, options, access, and convenience.

We want to save, invest, and make sound financial decisions on our terms. Fintech is giving us that. It is not here to fix something that’s broken; rather, it came to build a whole new financial experience from the ground up. It also helps the underserved community by creating more job opportunities (think of the POS stands and stalls) and ensuring that the common man can have a bank account for financial transactions.

Importance of Fintech

Here are four importances of fintech:

Financial Inclusion

Economic Growth

Innovation in finance

Youth Empowerment

Financial Inclusion: There are millions of people who are unbanked or underbanked, especially across Africa. Fintech is bridging that gap with tools anyone can access, even with just a smartphone.

Economic Growth: The more people participate in more transactions, businesses and investments, the more fintech empowers people through entrepreneurship and growing wealth among people.

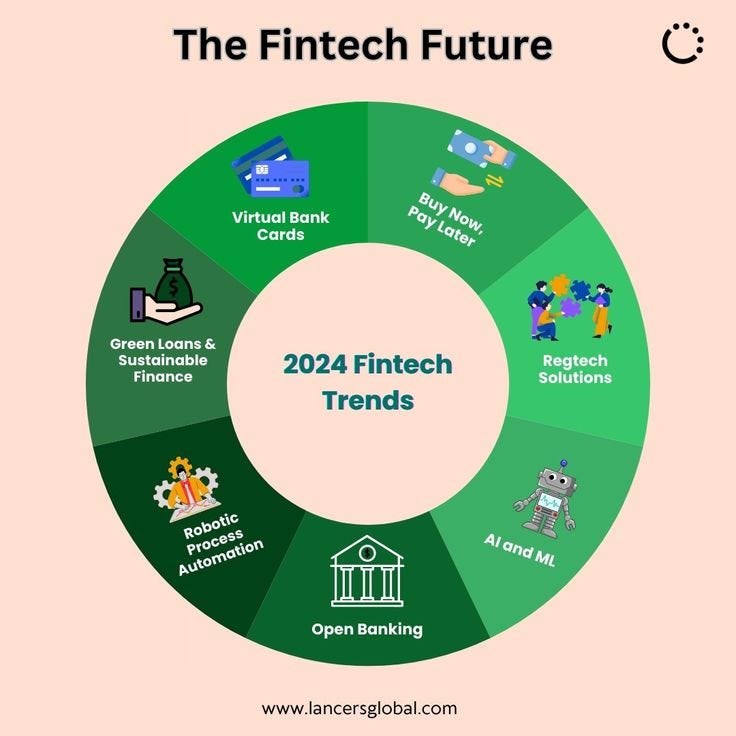

Innovation in finance: From financial education to budgeting tools to fractional investing, fintech keeps evolving and pushing traditional finance to level up.

Youth Empowerment: Young people are becoming more financially aware, learning, investing and building wealth, and getting smarter. Fintech is helping the next generation understand and own their money.

Benefits of fintech to society

Financial Education: Apps now teach us to budget, save and invest in simple and very engaging ways. Take Cowrywise, Trove, and PiggyVest on X (Twitter); they continue to educate young people in the language they understand.

Job Creation: There are so many parts or departments of a fintech company. From marketing to finance, legal, risk management, human resources, consultants, product managers and project managers, and more – amazingly it is opening new career paths, and a secret is that personally I’m looking forward to working at a great fintech company.

Access to global markets: With fintech, a student in Jos can invest in the S&P 500 or buy USDT. That kind of access was unimaginable a decade ago.

Better user experience: It’s fast, mobile-friendly, and personalised. No long forms or endless waiting.

Transparency and security: Many fintech platforms use encryption, biometrics, and real-time alerts. It’s safer and smarter.

Global Impact: Fintech adapts to local needs. From loan apps in Kenya to QR codes in China, it meets people where they are.

Conclusion

Fintech isn’t just “the future” — it’s now. It’s the reason you can buy shares with ₦1,000, save for emergencies without going to the bank, or send money across borders in minutes. And whether you’re a student, freelancer, side hustler, or full-time worker, understanding fintech gives you an edge. So next time someone asks you, “What is fintech?” — Don’t just define it. Show them how it’s already changing your life.

If fintech is already shaping the way we live and earn, then learning about it shouldn’t feel intimidating or boring. That’s what this space is for, breaking things down, connecting the dots, and helping you make smarter money + tech moves without the jargon.

If you enjoyed this read or learned something new:

👉🏽 Hit that subscribe button

👉🏽 Share this with someone who needs to stop sleeping on fintech

👉🏽 Drop a comment — I actually read them

See you in the next post my sugar babies? 👀